Shortly after the AstraZeneca board’s indecently hasty rejection of Pfizer’s (a.k.a. the praying mantis) “final” bid a few months ago, I said on Twitter that it would be nice to see some of them put their money where their cigars were.

Granted, I was mildly piqued by the speed with which the Pfizer bid was dismissed, because it had looked to me as if it had been a respectable premium to the selling price of AstraZeneca at the time. Furthermore, I do not consider it offensive to make a takeover offer for a company; after all anything listed on a market is by definition for sale at some price. The AstraZeneca hierarchy seemed to have taken the bid personally and allowed personal distaste to creep into their decision making. Well, that and a bit of political pressure which was being applied to them through the media.

On the other hand, in the pharmaceutical business, where the time between initial investment in a drug and its eventual sale is so long, it is extremely difficult for outsiders to judge the quality of a company’s pipeline. In other words, you have to put even more trust in the management running the company and the Board, who stand guard at the time of a takeover bid. Perhaps the board genuinely did feel that strongly that Astra’s pipeline was worth far more than Pfizer’s offer?

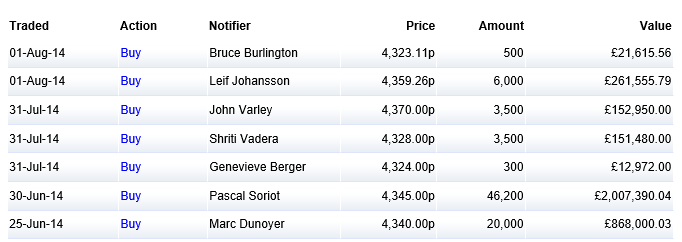

So, having abruptly thrown out Pfizer’s bids, did the AZN directors back their words with deeds and invest their own money? Here is the table of the most recent director deals:

You couldn’t really hope for a better show of support than that. While there might be many reasons that a director would want to sell a share–perhaps:

- An expensive separation

- A new Jag

- Golf club membership fees

- Devonshire holiday home purchase

- Fear of imminent profit warning

- Personal dislike or mistrust of the CEO/Chairman

- Alternative investment opportunity

- Industry knowledge of upcoming competition

There is only ever one reason why a director would buy shares in a company: they think it is undervalued.

Disclosure: I hold a position in AZN.

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.